Chronicle's Proof of Asset

What are RWAs?

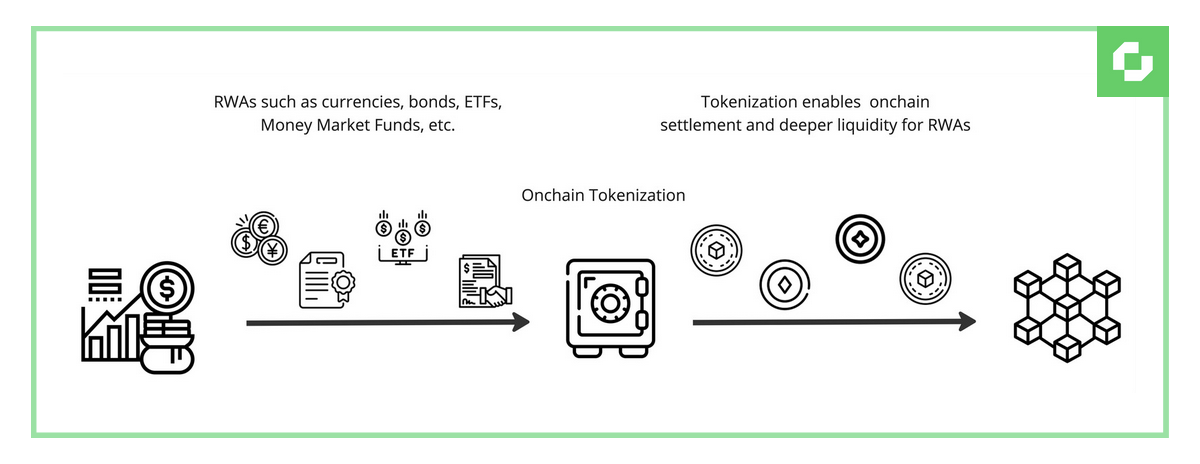

In the context of blockchain, Real-World Assets (RWAs) refer to physical assets and traditional financial instruments represented as digital assets on a blockchain network. These assets can range from assets such as real estate, commodities, art, and even intellectual property, to financial assets such as bonds, stocks, or ETFs. RWAs provide a bridge between traditional and decentralized finance opening up new opportunities for market inclusion, accessibility, and innovation.

Chronicle Proof of Asset

Proof of Asset can securely and transparently verify the integrity and quality of any offchain asset, transport the resulting data onchain, and distribute it directly to smart contracts and onchain products.

Proof of Asset leverages the unique advantages and long-standing reputation of Chronicle Protocol, extending them to any asset that originated offchain, such as Treasury Bills, FIAT currency, and gold, among others.

Leveraging Chronicle Protocol

Chronicle Protocol powers Proof of Asset, providing the infrastructure behind its unique capabilities.

-

Industry-Leading Validators: Chronicle’s decentralized and distributed network comprises reputable Validators like Gnosis, Gitcoin, Etherscan, Sky (MakerDAO), ETHGlobal, Infura, Nethermind, and many more. This network enhances the typical Byzantine Fault Tolerance of decentralized Validators with a unique 'Proof of Reputation' model, where each Validator effectively stakes its reputation. The canonical value of an Oracle is derived through the majority consensus of this community consortium, making the trust requirements for using a Chronicle Oracle equivalent to the trust in the crypto applications people use every day. The more Validators that join, the stronger this trust guarantee becomes.

-

Unrivaled Transparency & Verifiability: A uniquely transparent oracle network, every piece of information on Chronicle Protocol can be cryptographically verified by using the online dashboard, The Chronicle. This ensures the highest levels of transparency and data integrity, creating the first truly trustless Oracle network.

-

Cost-efficient: By using Schnorr signature aggregation, Chronicle cuts gas costs for onchain data delivery by 79% compared to competitors.

Chronicle's Proof of Asset Integrations

For a full overview of Proof of Asset integrations, check out the Chronicle Proof of Asset Dashboard.

-

Chronicle launched its Proof of Asset with an integration with M0. M0 uses Proof of Asset to provide proof of reserves for the M0 network supply, which is backed by U.S. Treasuries. By verifying offchain collateral before minting, Chronicle enables M0's stablecoin platform to scale with continuous solvency guarantees, eliminating unbacked issuance risk and supporting programmable digital dollars. To learn more, please refer to the following article.

-

Chronicle partnered with Centrifuge, a leading platform for innovative financial technology, to enhance the transparency of the Anemoy Liquid Treasury Fund (LTF). By integrating Chronicle’s Proof of Asset, Centrifuge can now provide real-time price updates and third-party verification for LTF, bringing unprecedented transparency to the fund’s operations.

-

Chronicle partnered with Superstate, an asset management firm focused on modernizing investing for institutional investors through tokenized financial products. Proof of Asset provides onchain, verified financial data for Superstate’s Short Duration US Government Securities Fund (USTB), including AUM (Assets Under Management), share price, and 7-day yield.

-

Chronicle announced that its Proof of Asset technology is enabling all winners of the Spark $1 Billion Tokenization Grand Prix to verify and manage their tokenized assets. BlackRock’s BUIDL, Superstate, and Centrifuge were named as the winners of the Spark Tokenization Grand Prix, securing allocations from Sky’s planned $1 Billion investment in tokenized real-world assets.

-

Chronicle has been named the Exclusive Oracle Partner to Grove, an institutional-grade credit protocol. Grove is a new star in the Sky ecosystem and recently announced a $1B commitment to a tokenized asset strategy including initial allocations to the Janus Henderson Anemoy AAA CLO Fund (JAAA) and the JTRSY Treasury Fund (JTRSY), both issued natively through Centrifuge. As Grove prepares to launch tokenized yield strategies backed by real-world assets (RWAs), Chronicle's Proof of Asset provides the oracle infrastructure required to safely and transparently scale credit allocation across the ecosystem they serve.

-

Chronicle has been selected by Centrifuge as its primary oracle partner. Centrifuge empowers asset issuers to bring real-world assets onchain - tokenizing, managing, and distributing funds through a single, transparent platform. By selecting Chronicle as its oracle partner, Centrifuge leverages Chronicle Proof of Asset to verify the underlying assets and holdings-level data of tokenized funds.