Chronicle's Verified Asset Oracle

What are RWAs?

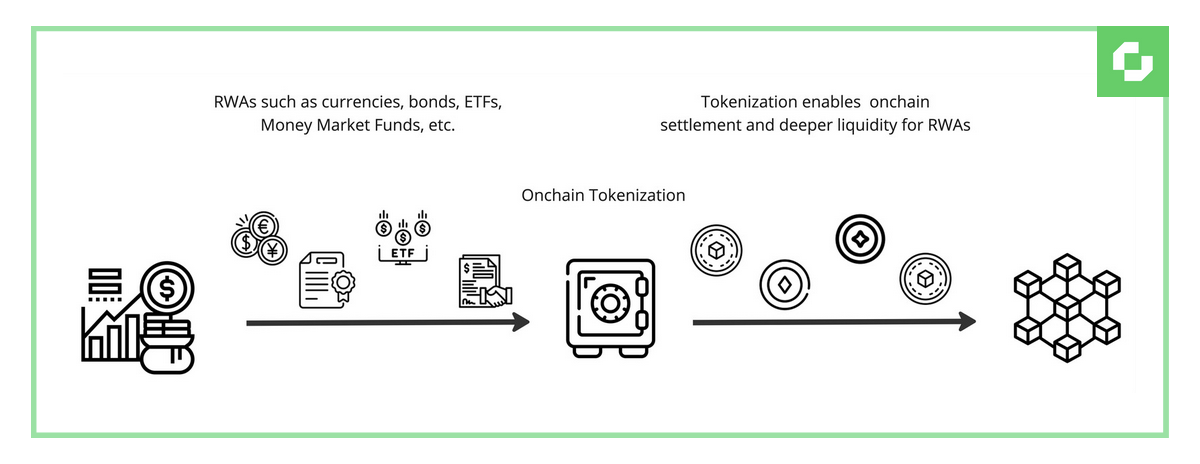

In the context of blockchain, Real-World Assets (RWAs) refer to physical assets and traditional financial instruments represented as digital assets on a blockchain network. These assets can range from assets such as real estate, commodities, art, and even intellectual property, to financial assets such as bonds, stocks, or ETFs. RWAs provide a bridge between traditional and decentralized finance opening up new opportunities for market inclusion, accessibility, and innovation.

The Chronicle Verified Asset Oracle

The Verified Asset Oracle (VAO) - formerly known as the RWA Oracle - can securely and transparently verify the integrity and quality of any offchain asset, transport the resulting data onchain, and distribute it directly to smart contracts and onchain products.

The Verified Asset Oracle utilizes the unique advantages and long-standing reputation of Chronicle Protocol, extending it to any asset that originated offchain, such as Treasury Bills, FIAT currency, and gold, amongst others.

Leveraging Chronicle Protocol

Verified Asset’s unique advantages are imbued by Chronicle Protocol, the infrastructure layer that the VAO employs.

-

Industry-Leading Validators: Chronicle’s decentralized and distributed network comprises reputable Validators like Gnosis, Gitcoin, Etherscan, MakerDAO, ETHGlobal, Infura, Nethermind, and many more. This network enhances the typical Byzantine Fault Tolerance of decentralized Validators with a unique 'Proof of Reputation' model, where each Validator effectively stakes its reputation. The canonical value of an Oracle is derived through the majority consensus of this community consortium, making the trust requirements for using a Chronicle Oracle equivalent to the trust in the crypto applications people use every day. The more Validators that join, the stronger this trust guarantee becomes.

-

Unrivaled Transparency & Verifiability: A uniquely transparent oracle network, every piece of information on Chronicle Protocol can be cryptographically verified by using the online dashboard, The Chronicle. This ensures the highest levels of transparency and data integrity, creating the first truly trustless Oracle network.

-

Increased Security and Decreased Cost: Independently verified as the most cost-efficient blockchain Oracle network, Chronicle uniquely applies Schnorr signatures to unlock an unlimited number of validators and reduce gas costs for delivering data onchain by 60-80% versus the competition. This innovation allows for a more decentralized, and therefore more secure, network.

Chronicle's Verified Asset Oracle Integrations

-

Chronicle launched its Verified Asset Oracle (formerly known as Real World Asset Oracle) with an integration with M^0, a decentralized onchain protocol, as well as a set of off-chain standards and APIs, that allows multiple Minters to issue a fully fungible cryptodollar called $M. This collaboration allows to provide onchain information on the presence of offchain collateral (currently short term T-bills) used by Minters to generate $M cryptodollar. To learn more, please refer to the following article.

-

Chronicle partnered with Centrifuge, a leading platform for innovative financial technology, to enhance the transparency of the Anemoy Liquid Treasury Fund (LTF). By integrating Chronicle’s Verified Asset Oracle, Centrifuge can now provide real-time price updates and third-party verification for LTF, bringing unprecedented transparency to the fund’s operations.

-

Chronicle partnered with Superstate, an asset management firm focused on modernizing investing for institutional investors through tokenized financial product, to integrate the Verified Asset Oracle, raising the standard of verification of ‘real-world assets’. Initially, this integration will provide the onchain net asset value (NAV) data for Superstate’s Short Duration US Government Securities Fund (USTB).